Spin Crunch

Spin Crunch

Financial Analysis, Credit Scoring and Risk Assessment.

Get a credit report in less than 2 minutes!

Benefits You get!

Spincrunch enables you streamline your business process by giving you the following.

Faster TATs

Reduce your credit analysis process by 90%!

Save up-to 3 hours per statement analysis.

Get your Spinreport in Under 3 Minutes

Fraud Detection

Avoid having fraudsters use fake or forged statements to get Loans from you!

Kick Out 99% of Fraudsters !

Understand Client Behavior

Get a deep understanding of how your clients spend money and the kind of lifestyle they enjoy.

Follow the money, Understand the person.

"Data is reality. If you face it, you can understand it"

How it Works

Our 3 step process on how to process statements.

Request Statement

GET AN E STATEMENT FROM YOUR BORROWER

LETS GET STARTED

Ask your borrower to request financial statement from their Bank or Mobile Money Provider and forward it to you without renaming it.

Send statement.

Forward Statement To the Spin mobile System to begin crunching

Avoid having fraudsters use fake or forged statements to get Loans from you!

Upload

Log in to our dashboard and directly upload the statement into Spin Crunch.

API

Connect Spin Crunch directly to your Lending system and automatically send statements to us.

Get Spin Report.

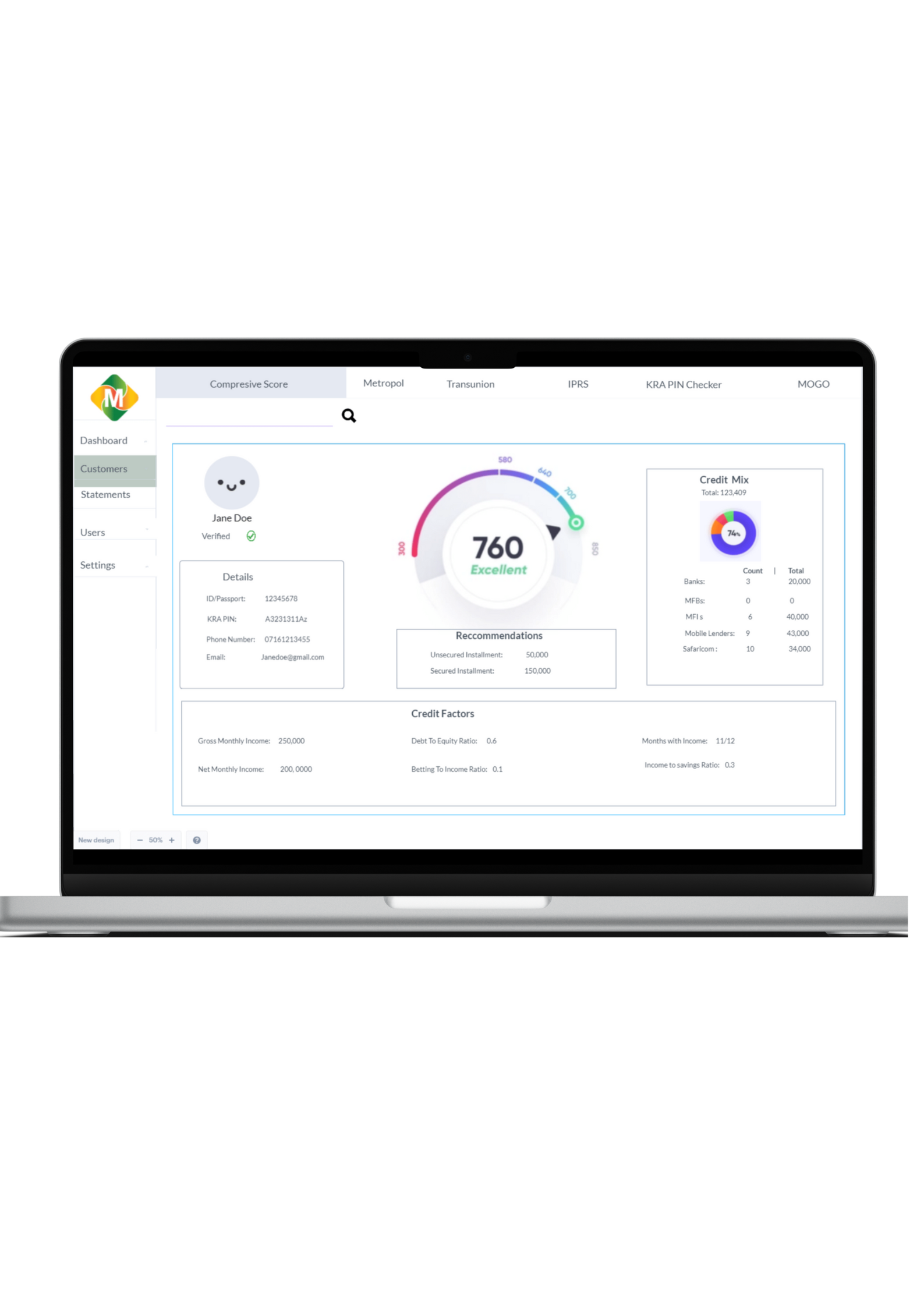

Spin Dashboard

Log in to the Spin Crunch dashboard and see the holistic Spin Report.

API

Let Spincrunch automatically push the Spinreport directly to your Core Banking System

Use Cases

Fast decision making on Loan affordability

Spincrunch provides recommended amounts for both secured and unsecured loans.

We also provide historical information on highest loan amounts provided by other lending institutions for bench-marking.

Risk analysis of Borrower

Spincrunch provides a risk matrix depending on the customer’s financial liquidity and behavior.

We take the time to analyze what your customer does with their money so that you

Cash Flow analysis

Spincrunch provides you with a breakdown of the liquidity of your customer on a daily, weekly and monthly basis.

This helps predict when the customer is best suited to pay you back.

External CRBs

Spincrunch is integrated with Metropol and Transunion Credit bureaus to give you a holistic view of the customer.

Understand your customers spending habits

Spincrunch shows you where the money is coming from and where it is going to.

We categorize where customers are spending their money the most.

As the saying goes “ Follow the money …”

How much of their income are they spending on drinking?

Does your customer have a gambling addiction?

Spin Crunch provides a fair head to head analysis on how much your customers spend on betting and how much they receive back.

Do they borrow money to bet?

Saving culture

Spincrunch does analysis on whether your customer saves or not.

What percentage of their income do they save?

Can they pay you back if there is a disruption in their income stream?

Up selling opportunities

Spincrunch analyzes financial data and finds opportunities for you to up sell other products such as insurance or school fees loans.

Are your customer’s car owners?

Do they have children in school?

Close contacts

Spincrunch provides you with people who are the closest to your customer.

Probable locations

Spincrunch provides you with possible locations where you can find the customer if they decide to go MIA on you.

It also acts as a verification mechanism on locations registered by customers.

Are you afraid of fake bank statements?

Spincrunch has an extensive security check system that is dedicated to verifying the authenticity of E-statements to protect you from fraudsters.